A non-profit initiative of the Mark Cuban Foundation to teach the basics of Artificial Intelligence to underserved high school students across the U.S. We hope you enjoy these 19 Books Recommended by Mark Cuban, Mark Cuban is the multi-billionaire dollar man, who has a long list of accomplishments: “shark” investors on the ABC reality television, owner of the Dallas Mavericks basketball team and co-owner of Magnolia Pictures and authoring “How to Win at Sports of Business”.

Mark Cuban

(American Businessman, Investor, Author, Television Personality, and Philanthropist)

Name: Mark Cuban

Date of birth: July 31, 1958 (age 58)

Place of birth: Pittsburgh, Pennsylvania, U.S.

Occupation: Owner of Dallas Mavericks, part owner of 2929 Entertainment, Chairman of AXS TV, Owner of Landmark Theatres, Television personality, Entrepreneur

Father: Norton Cuban

Mother: Shirley Cuban

Siblings: Brian Cuban

Spouse: Tiffany Stewart (m. 2002)

Mark Cuban Net Worth

Children: Alyssa Cuban, Jake Cuban, Alexis Sofia Cuban

Early Life

Mark Cuban was born on July 31, 1958, in Pittsburgh, Pennsylvania, U.S. He is a well-known American personality. He is a seasoned businessman, investor, author, television personality and philanthropist. Mark Cuban is said to have had a remarkable ability of selling even as a child. This later helped him establish diverse businesses and succeed in every enterprise equally well. Though he began his career in a modest manner, he later went on to establish businesses in diverse fields such as software, film distribution, investing in social startup companies and owning the NBA basketball team – Dallas Mavericks. Most of his businesses were initiated at a time when the world was witnessing the internet boom and this helped him gain maximum benefit. Mark Cuban is popular for his verbose personality and voicing out his unrestricted opinion both on and off camera. This has got him into trouble a number of times. He is an ardent fan of the Russian-American novelist Ayn Rand and has mentioned that reading the book ‘The Fountainhead’ allowed him to think as an individual, take risks towards success and responsibility for failures. This self-made billionaire is constantly on the lookout for what’s new, what’s next and how he’s going to get there first.

Childhood and Educational Life

Mark Cuban was born on 31 July 1958 to Norton Cuban and Shirley in Pittsburg, Pennsylvania. His father worked at a car upholstery shop. His grandfather, Morris Chobanisky, emigrated from Russia and fed his family by selling merchandise out of the back of a truck.

Like his grandfather, Cuban displayed a tenacity for making a deal and carving out a better life for himself. At the age of 12, he sold sets of garbage bags to save up for a pair of shoes he liked. In high school, he earned extra dollars any way he could, mainly by becoming a stamp and coin salesman.

As a child, he attended the Mount Lebanon High School at Pennsylvania. Even at a young age he managed to earn money through part time jobs.

After his schooling Mark Cuban enrolled into the University of Pittsburg. However, after a year he transferred into Indiana University in Bloomington and in 1981 graduated with a Bachelor of Science in Business Administration. He chose Indiana’s Kelley School of Business without even visiting the campus because “it had the least expensive tuition of all the business schools on the top 10 list”. During college, he had various business ventures, including a bar, disco lessons, and a chain letter.

Personal Life

Mark Cuban married Tiffany Stewart in the year 2002 at Barbados. They have three children; daughters Alexis Sofia (born 2003), Alyssa (born 2006) and son Jake (born 2010). They live in a 24,000-square-foot (2,200 m2) mansion in the Preston Hollow area of Dallas, Texas.

Working Career

After graduating in 1981, Cuban moved back to Pittsburgh and took a job with Mellon Bank, just as the company was ready to switch over to computers. Cuban immersed himself in the study of machines and networking. However, he had no real desire to hang out in his home city for too long, and in 1982 he left Pittsburgh for Dallas. He later went on to work as a salesperson of a personal computer software retailer chain named Your Business Software, in Dallas. Mark Cuban was fired from work within a year.

At this point he founded a computer software consulting service called MicroSolutions. His previous experience in this field gave him the knowledge and skills required to initiate the business. He started with the assembling of systems and reselling computer software. In 1990, he managed to sell the company to CompuServe Information Service in a multi million deal.

In 1995, Chris Jaeb and fellow Indiana University alumnus Todd Wagner started Audionet (which Cuban started to fund in 1998), combining their mutual interest in Indiana Hoosier college basketball and webcasting. With a single server and an ISDN line, Audionet became Broadcast.com in 1998. By 1999, Broadcast.com had grown to 330 employees and $13.5 million in revenue for the second quarter. In 1999, Broadcast.com helped launch the first live-streamed Victoria’s Secret Fashion Show. That year, during the dot com boom, Broadcast.com was acquired by Yahoo! for $5.7 billion in Yahoo! stock.

After the sale of Broadcast.com, Cuban diversified his wealth to avoid exposure to a market crash. In 2011, Cuban was No. 211 on Forbes’ list of “World’s Richest People”, with a net worth of $2.6 billion. The Guinness Book of Records credits Cuban with the “largest single e-commerce transaction”, after he paid $40 million for his Gulfstream V jet in October 1999.

Mark Cuban along with partner Todd Wagner founded a media group named 2929 Entertainment, in 2003. 2929 co-produced a renewed version of the television show ‘Star Search’ that year. The same year the partners purchased Landmark Theatres – the largest movie theatre chain in USA, and film the distributor Magnolia Pictures.

In November 2003, Mark Cuban introduced High Definition Television into the market; he was the co-founder of AXS TV – the primary HD satellite TV network.

In 2004, Mark Cuban in collaboration with ABC Television launched a reality series ‘The Benefactor’. However, due to low ratings, the show went off air shortly after its launch. He also owned the Internet Search Engine – Ice rocket that was launched in 2004. Apart from this he was a partner in the startup – Red Swoosh- an initiative that allows peer-to-peer file sharing. This company was later bought by Akamai Technologies, in 2007.

In 2004, Cuban caught the attention of the Security and Exchange Commission (SEC), which charged him with insider trading in regards to an Internet search engine website. Cuban claimed he was innocent, and in July 2009 the case was dismissed. However, the case was reinstated the following year. It was also during this time that Cuban joined the series Shark Tank as a venture capitalist, allowing for the trial to be put on hold. In March 2013, Judge Sidney A. Fitzwater let the case go to trial once again. The trial began on October 1, 2013. Later that month, he was officially cleared of all charges of insider trading by a Texas jury.

In 2005, he funded Brondell Inc; A US based startup that made hi-tech closet seats. The following year he invested in a website named Sharesleuth.com that aided in revealing fraud and reducing the spread of false information.

In July 2006, Cuban financed Sharesleuth.com, a website created by former St. Louis Post-Dispatch investigative reporter Christopher Carey to uncover fraud and misinformation in publicly traded companies. Experimenting with a new business model for making online journalism financially viable, Cuban disclosed that he would take positions in the shares of companies mentioned in Sharesleuth.com in advance of publication. Business and legal analysts questioned the appropriateness of shorting a stock prior to making public pronouncements which are likely to result in losses in that stock’s value. Cuban insisted that the practice is legal in view of full disclosure.

In April 2007, Cuban partnered with Mascot Books to publish his first children’s book, Let’s Go, Mavs!. In November 2011, he wrote a 30,000-word e-book, How to Win at the Sport of Business: If I Can Do It, You Can Do It, which he described as “a way to get motivated”.

In October 2008, Cuban started Bailoutsleuth.com as a grassroots, online portal for oversight over the U.S. government’s $700 billion “bailout” of financial institutions.

In 2012, Mark Cuban donated money to a legal nonprofit organization in the USA by the name Electronic Frontier Foundation in order to support their work.

The Mark Cuban foundation initiated the Fallen Patriot fund that helps families of US military persons who were either injured or killed during the Iraq war.

Cuban again courted controversy in May 2014. According to USA Today, he made some comments that were widely perceived as racist. On the subject of bigotry, he stated, “If I see a black kid in a hoodie on my side of the street, I’ll move to the other side of the street.” Cuban then explained that he tried “to always catch my prejudices.” Cuban later expressed remorse for his comments, posting, “I didn’t consider the Trayvon Martin family, and I apologize to them for that.” He also tweeted that “I have my failings … but a racist I am not.”

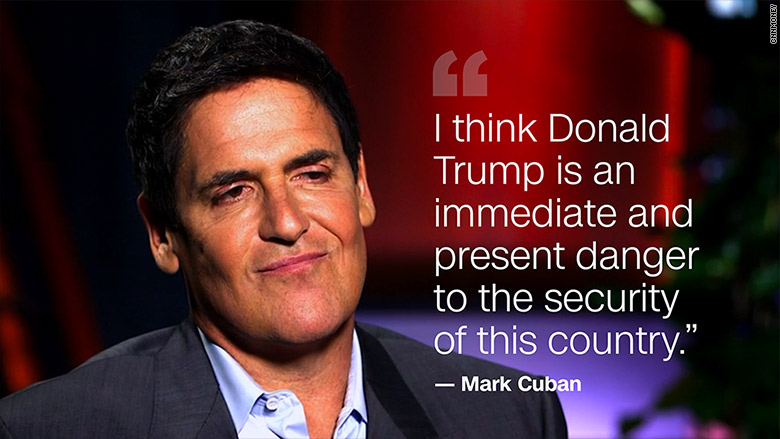

Cuban remained on top of technology trends by launching a social media app called Cyber Dust in 2014. True to form, he also thrust himself into the national conversation when inspired, boasting he could beat both Hillary Clinton and Donald Trump as campaigning for the U.S. presidency heated up in 2015. In July 2016, the billionaire threw his support behind Hillary Clinton.

Awards and Honors

Business

1998 Kelley School of Business Alumni Award – Distinguished Entrepreneur: 1998

2011 D Magazine CEO of the Year

Sports

2011 NBA Champion (as owner of the Dallas Mavericks)

2011 Outstanding Team ESPY Award (as owner of the Dallas Mavericks)

Television

Two-time Primetime Emmy Award for Outstanding Structured Reality Program winner (as a cast member of Shark Tank) – 2014, 2015

Having listened to many CrossFit affiliate owners both in person and in podcasts, it is hard not to compare their views of the business of CrossFit with that of the blind men considering the elephant.

At the affiliate level there certainly is no unanimity on the best approach going forward. Some affiliates have closed, others have gone exclusively online, and others have struggled to maintain a client base within the constraints of local COVID-19 regulations. What is clear is that from an affiliate’s perspective, there is no one-size-fits-all business model that is appropriate.

The economics of running an affiliate in extreme rental markets like New York City, San Francisco or Hong Kong differ from those in more affordable markets like Indianapolis, Sao Paulo or Reykjavik, and differ even further from places like Aberdeen, SD or Nairobi, Kenya or Nuuk, Greenland. An individual affiliate owner need not worry about the different markets or the different parts of the elephant; for CrossFit HQ it is a very different story.

Two Considerations

The first consideration is the distinction between short run and long run.

What needs to be done today just to survive? Many of us have a “to-do list” for today’s chores. In the age of a pandemic, for an affiliate owner, such a list is critical. What do I need to do today to make sure that my affiliate can survive until the pandemic is over? The focus on today, on the short term, is understandable. The pandemic only heightens that short-term focus as it complicates almost every day-to-day issue, e.g. keeping the gym clean and safe, retaining athletes, and paying the bills. But focusing on the short run potentially threatens the ability to make decisions for the long run.

The second consideration is determining what are your long-term goals and constraints and determining how they can be addressed.

The best analogy is training for the Open. Most of us don’t want to be in the same position two or five or ten years down the road as we are now. We hope to be better versions of ourselves and that may mean simply being more fit and healthy or being better at pull-ups or muscle-ups or handstand walks. And we understand that our day-to-day programming — today’s “to-do list” — needs to be structured appropriately to make that happen. Affiliate owners need to ask the same question of themselves and their affiliate. But it’s not just a question of setting goals; it’s also a question of recognizing constraints and incorporating those constraints into the decision-making process.

A Distressing Comparison

A comparison with the fitness chain Curves should serve as a cautionary tale. Curves is a company of fitness facilities for women, with the original gym opening in 1992, franchising (not affiliation) starting in 1999 and growing to about 10,000 franchises by 2006.

Controversy associated with the owner and a less than ideal business model led to a dramatic drop in franchises with many disassociating with the brand and others simply closing. The current number of franchises appears to be about 350. Curves went from being ubiquitous to being an afterthought in about a year. Much of that story should sound distressingly familiar.

The standard assumption of economists is that firms attempt to maximize profits. That is not an unreasonable starting point, but as an economist who has worked extensively on the economics of sports, I take a different and more nuanced view. Focusing on sports clearly indicates that many franchise owners do not maximize profits. Owners of sports franchises generally do not want to lose money, but most are willing to trade profits for wins, at least up to a point. And the decisions that those owners make will be influenced by how much they value winning vs. how much they care about making money.

The quality of any affiliate depends critically on the quality of their coaches, and to attract and retain quality coaches implies paying them a living wage.

The same is true for other businesses, albeit in most cases not so explicitly, and that includes CrossFit. Under the previous owner, beyond making money, the goal appeared to be changing the world, e.g. taking on big soda and big pharma. It is challenging to look at the decisions made and fit them into anything approaching a standard business model.

With Eric Roza now in charge, there appears to be a focus on operating CrossFit as a traditional business, focusing on customers — affiliate owners, and athletes, both elite and the rest of us — and working to grow the business by meeting customers’ needs and desires. Eric Roza signaled that CrossFit would be run as a business by having Berkshire Hathaway as a partner.

What does that mean for CrossFit HQ and for affiliates?

First, it suggests an emphasis on growth. Roza has stated that his goal is to get 500,000 participants in the 2021 Open and over time increase that number to over one million. Those targets may appear unrealistic or aspirational, especially with COVID-19 still raging. However, over 1.8 million people have previously signed up for at least one Open. With advertising and word-of-mouth, Roza’s goals are not as far fetched as they may sound. Long-term Open growth suggests that the objective is to also increase the number of affiliates.

Second, to address your customers’ needs, you need to understand what those needs are. Previously, at least to this outsider, it appeared that there was little feedback from affiliates or athletes to HQ. Roza has reached out both to athletes and affiliates to get their perspectives. In addition, affiliates and athletes now have representative groups to convey issues and concerns to HQ.

Third and perhaps most importantly, there needs to be a business model at HQ level that generates profits — even if that is only a secondary motivation — and that also generates profits for well-run affiliates, whether they are in NYC or Nuuk.

Frankly, it is this last piece that appears by far to be the most challenging. Why? Consider three groups.

There needs to be a business model at HQ level that generates profits and that also generates profits for well-run affiliates, whether they are in NYC or Nuuk.

First, coaches. The quality of any affiliate depends critically on the quality of their coaches, and to attract and retain quality coaches implies paying them a living wage.

Second, athletes. The financial viability of an affiliate depends critically on attracting sufficient athletes to be able to cover expenses and to do so at a price that does not exclude a large fraction of the potential target audience. And third, underserved communities. How do you combine the first two factors to introduce CrossFit to audiences that may be most in need of improved health but have the least ability to pay?

This last point is primarily a long term challenge, albeit a challenge to begin addressing today. Are there a set of actions that HQ can begin to undertake for marketing, for pricing, for incentives, for growth, … that will make affiliates and HQ financially successful, coaches paid appropriately and athletes around the world and from all backgrounds paying reasonable fees? CrossFit starts with a revolutionary approach to fitness, an enthusiastic base of aficionados, and a growing ecosystem of external businesses that can facilitate progress.

Mark Cuban Wife

Like a muscle-up, describing what needs to be done is relatively easy; constructing and implementing the correct strategy to get there is not.

Get the Newsletter

Mark Cuban&rsquo S Business Perspectives Definition

For a daily digest of all things CrossFit. Community, Competitions, Athletes, Tips, Recipes, Deals and more.

Daymond John

Sign in to Comment